1.4.2. Value Chain Analysis - Overview

Introduction

Image

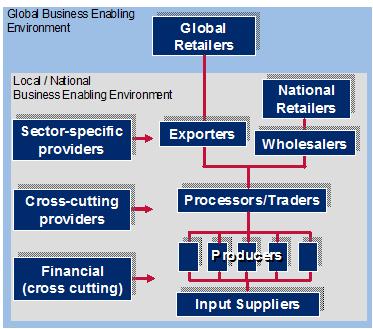

Value chain analysis is a process for understanding the systemic factors and conditions under which a value chain and its firms can achieve higher levels of performance. When using value chains as a means for fostering growth and reducing poverty, the analysis focuses on identifying ways to contribute to two objectives: i) improving the competitiveness of value chains with large numbers of small firms, and ii) expanding the depth and breadth of benefits generated.

Typically, the aim of value chain analysis is to understand all the major constraints to improved performance or competitiveness. However, USAID recommends a strategic approach that focuses on understanding end-market opportunities and the constraints to these opportunities—such an approach obviates the need to understand all constraints and narrows the scope of the analysis to "constraints to opportunities."

The results of the analysis offer industry stakeholders a vision for value chain competitiveness and form the basis for a competitiveness strategy—a plan for eliminating constraints to end market opportunities and advancing sustainable competitiveness (graphically depicted on right).

| Go directly to How to Conduct Value Chain Analysis |

|---|

What Does Value Chain Analysis Entail?

In identifying opportunities for upgrading and the constraints to these opportunities, the analysis should focus on answering the following questions:

- What and where are the market opportunities? (End market analysis)

- What upgrading is needed to exploit them? (End market and chain analysis)

- Who will benefit from this upgrading? (Chain analysis)

- Who has the resources, skills and incentives to drive upgrading? (Chain analysis)

- Why has it not happened already? (Chain analysis)

- What will it take to make it happen? (End market and chain analysis)

End Market Analysis

End market analysis goes beyond confirming the general existence of demand to understanding market trends, high-potential market segments, benchmarking and market positioning. Research into market trends highlights where the industry is headed in the future in terms of opportunities, problems and competition. Market segmentation identifies the segments of the larger market that offer the greatest opportunity for a particular value chain, given its capacity. Within a market segment, benchmarking identifies and compares competitors with one another against criteria important to buyers. Market positioning involves identifying the various positions of competitors in a given market segment in terms of their competitiveness strategy (lower cost, better quality, etc.) and selecting a position that will maximize competitive advantage. While secondary data can be important to understanding market trends, primary research with buyers is critical to effective segmentation, benchmarking and positioning. Finally, good end-market analysis will include buyer contacts--the names, addresses, contact information and specifications of buyers who have articulated a clear interest in purchasing the product or service in question if certain conditions are met.

Image

Chain Analysis

Chain analysis focuses on constraints to the opportunities identified in the end market analysis. The value chain framework defines the scope of the chain analysis, serving as a checklist and organizing framework for the research. Chain analysis examines both structural and dynamic factors affecting value chain competitiveness and the depth and breadth of benefits, including:

Structural factors

- end markets

- business enabling environment

- vertical linkages

- horizontal linkages

- supporting markets

Dynamic factors

- value chain governance

- inter-firm relationships

- upgrading

How to Conduct Value Chain Analysis

Value chain analysis is a process that requires four interconnected steps: data collection and research, value chain mapping, analysis of opportunities and constraints, and vetting of findings with stakeholders and recommendations for future actions. These four steps are not necessarily sequential and can be carried out simultaneously.

Briefly, the steps can be described as follows:

- The value chain team collects data through primary and secondary sources by way of research and interviews.

- The team compiles a value chain map, which helps to organize the data.

- By using the value chain framework, the collected data is further organized and analyzed to reveal opportunities and constraints within the chain.

- The resulting analysis of opportunities and constraints is vetted with stakeholders and used to design a strategy for the value chain to improve competitiveness and to agree on upgrading investments.

| Click here for information on how to conduct value chain analysis. |

|---|