3.3.1. End Market Competitiveness Plan

Determining Where to Compete

An end-market assessment is the first step in determining where it is possible and most advantageous for a value chain to compete. In some cases, there are several end markets, each having different needs.

Example: The Haiti End-Market StudyBarber.T.(2007).Global Market Assessment for Handicrafts:DAI (https://www.marketlinks.org/resources/global-market-assessment-handicrafts-vol-1) found that although there are a number of different markets for Haitian folk art and accessory products, Haiti should not focus on exporting to big box stores (large, integrated importer-retail outlets such as Wal-Mart, TJMaxx, Pier 1 and Pottery Barn), but rather on selling to U.S. boutique stores. In order to meet the needs of this market, the value chain needed to introduce agents who could serve as intermediaries between the English-speaking boutique owners who had very specific product and delivery requirements, and the many different and largely uncoordinated factories and small-scale craft workshops. Haiti also should look to regional markets where Haitian handicrafts dominate and to local markets where Haitians and the large community of foreign officials, peacekeepers, and aid workers value the creativity and craftsmanship of local artists and are willing to pay high prices. In addition to being more forgiving, regional and local markets offer artisans opportunities to develop their craft and experiment with designs, production, quality, packing and other details before attempting to enter the more demanding and competitive U.S. and European markets.

Determining How to Compete

The goal of the value chain approach is to enable private-sector stakeholders to act on their own behalf — to upgrade their firms and collectively create a competitive value chain that contributes to economic growth with poverty reduction. Following the assessment of potential end markets, project implementers can provide stakeholders with the information they need to develop and take ownership of a strategy to compete in specific markets. When industry leadership is weak, implementers usually determine how the chain can best compete in the marketplace and develop a strategy to create a competitive advantage built around efficiency, differentiation and/or market focus. When leadership is strong, however, stakeholders can develop this strategy themselves with support. Stakeholders must buy into the resulting competitiveness strategy and take responsibility for and commit their own resources to undertaking needed upgrading activities. They must recognize the need to collaborate at some level—as well as compete—with other firms in the chain.

A firm or industry can be set apart from its competitors in the following ways:

Product: the uniqueness of a product or service in terms of its price/quality ratio as compared to competing products or services. Differentiating a product can be done in two ways:

- Product characteristics: qualities of the product that are not easy to replicate such as taste, look, results, origin, etc.

- Production process: a growing/manufacturing/assembly process that provides one or more characteristics to the product or service that separates it from the competition – e.g., organic, HACCP, Halal, etc.

Sample of Marketing Tactics for Differentiating Product/Production Process |

|---|

| Quality guarantees: Refunds for defects or products/services that do not meet specific characteristics |

| Third-party testimonials: Having a respected and relevant third-party organization provide a reference regarding the product – e.g., private laboratory quality endorsement |

| Certifications: Private or public (domestic or international) standards that the product or service (or the production process) can obtain that reenforce key product characteristics – e.g., organic certification, ISO, HACCP, etc. |

Example: For specialty coffee, the competitive strategy must bolster the product’s position in the market place as being unique and having qualities that are not easily found in other coffees. It is by producing a reliable product that meets these qualities that specialty coffee value chains can maintain and improve their competitive position. Of course, operations play an important part, but operational improvements can not be introduced if they compromise product integrity and uniqueness. In specialty coffee, product certifications, geographic branding, and on-farm and processing improvements could all be parts of an upgrading strategy, but the characteristics that define how the product is differentiated in the market remain the most important considerations of any strategy.

Operations: the ability of a firm or industry to assess an opportunity and follow through to meet buyers’ expectations over time – i.e., matching firm or industry capacity with market requirements, and fostering reliance on the firm or industry’s ability to deliver consistently. Operational differentiation can be achieved in the following ways:

- Strategic market choices: assessing and shifting marketing, production or distribution tactics to take advantage of opportunities arising from a value chain’s structure or from market trends, such as

- Seasonality: scheduling production to obtain higher off-season or high-demand (e.g., during holidays) prices

- Financial flows: targeting cash-rich periods (i.e., harvest time) or internal remittance flows

- Channel requirements: targeting market channels that better fit a firm or industry's competitive capacities such as lower volume/higher margin or contracted production channels

- Efficiency: getting a product or service to the end client at a basic quality level cost-effectively over time

- Consistency of meeting expectations: meeting timeliness, quality and volume requirements over time

- Customer service: managing client expectations resulting in a relatively high percent of repeat buyers

Sample of Marketing Tactics for Differentiating by Operations |

|---|

| Targeted promotional events and campaigns: Harmonize promotional investments with seasonal opportunities. (e.g., promotions/marketing aligned with off-season price spikes, etc.) |

| Shift promotional investments to align with financial flows: Harmonize promotional investment with cash inflows, including remittances. Shift the order or distribution process to handle remote purchases and delayed deliveries as required. |

| Packaging/operational shifts: Harmonize end market requirements with packaging and operations (e.g., hotels and restaurants want small table-ready products rather than bulk purchases) |

| Client satisfaction guarantees: Refunds for defects and/or unmet expectations (quantity, quality, customer treatment, etc.) related to operations |

| Code of conduct: A commitment to a set of behaviors that are presented to clients with specific mechanisms for enforcement and client complaints |

| Certifications: Private or public (domestic or international) standards that reinforce key firm characteristics – TQM, GMP, ISO, fair labor practices, etc. |

Example: The cotton industry in Zambia does not produce cotton that is sufficiently different to warrant substantial premiums; it can not be distinguished from competing product in other countries. As a result, the industry has to out-compete its competitors by being more strategic in its market choices, increasing it efficiency, meeting customer volume and timeliness requirements, and/or building stronger customer loyalty. Efforts to improve the competitive position of this industry have to be grounded in upgrading the way the industry operates including reducing transaction costs at all levels of the value chain, fostering standards to improve consistency in meeting customer requirements, increasing on-farm yields, and fostering specialization via support markets for some functions.

Brand: the perceived uniqueness of a firm or industry--in general, or with regard to one or more specific products. Branding can be achieved through the following techniques:

- Marketing tactics: organizing branding characteristics (price, product, promotion, place and people) into a comprehensive approach/plan to promote a firm or industry’s image consistent with the branding objectives. For example firms that brand by elite social status are called luxury brands and include Gucci, Armani, Rolex, etc.. These firms need to structure their branding characteristics to foster an image of privilege and wealth. Besides status, branding can also be based on cultural or political issues (e.g., social responsibility – Bodyshop), emotions (e.g., joy - Coca cola) and/or human characteristics (e.g., strength – Mr. Clean).

- Legal and operational tactics: establishing legal and operational protection of a brand. Through intellectual property rights, staff management principles, and promotional tactics firms and industries can decrease the risk of brand value being deteriorated through poor or unauthorized use

Sample of Marketing Tactics for Differentiating by Brand |

|---|

| Promotional campaign: A series of tools (e.g., events, advertising, discounts, etc.) that support branding objectives and are intended to increased sales |

| Public relations campaign: A series of tools (newspaper articles, news releases, press conferences, press interviews, funding relevant events/activities, etc.) that support branding objectives and are intended to define the image of a firm or industry |

| Brand linkage: Strategic alliances between firms or industries that reinforce branding objectives, e.g., Barcelona and Care. |

| Certifications: Private or public (domestic or international) standards that a firm can obtain and that reenforce key firm branding objectives – e.g., Starbucks Black Apron, Fair Trade, etc. |

| Effective staff development and compensation: Staff are a firm's primary branding tool and proper investment can be the best insurance for brand protection |

| Legal protection: Depending on legal options, copyright laws and patents can offer some level of protection of a brand |

Example: For developing countries, branding as the key competitveness strategy can be difficult, but for value chains like cotton (Egypt), specialty coffee (Ethiopia) and spices (Madagascar), geographic branding can increase the margins of a differentiated product and foster product loyalty. Egyptian cotton is one of the earliest examples of a developing country value chain seizing on its name recognition that arose from specific product qualities to push margins and loyalty by using branding to link product characteristics to a geographic location. Ethiopian coffee is a more recent example, and efforts to brand spices are ongoing in a number of countries, including Madagascar. In other cases, branding at an industry level can be useful in increasing investment and fostering demand when operational competency differentiates one country’s industry from another. Kenya floriculture and horticulture are examples of operational competency driving growth and recognition. The key issue here -- and one that has limited these Kenyan industries -- is the ability of industry players to cooperate on industry-wide constraints and agree to an industry-wide branding strategy.

Determining the Products and Operational Characteristics Required to Compete

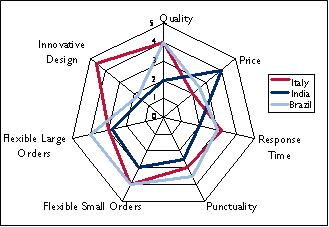

Once an industry identifies a market segment to target and a strategy to create competitive advantage, it becomes essential for all actors in the chain to learn more about consumer tastes and market trends and to understand what they need to do to adapt their operations and processes to meet strategy requirements. The spider diagram is a useful tool that allows strategy designers and value chain actors to understand the product or service characteristics that are most important to buyers and how buyers rate a producing country in relation to its closest competitors. The figure below shows buyer perceptions of the leather footwear industries in Brazil, India and Italy. For example, the diagram allows firms in Brazil to see that to compete for market segments dominated by India, they should rely on efficiency since price drives buyers’ decisions. However, to compete for Italy’s share of the market, the diagram shows that quality and innovation are highly valued and in this case, a differentiation strategy may be most advantageous.

Determining the Products and Operational Characteristics Required to Compete

When using a tool such as the spider diagram to understand the characteristics that determine how a country's products might compete in specific end-markets, firms may rethink ways they can create competitive advantage. Identifying end markets to compete in is an iterative process in which the where, how and what continually feed into each other.