1.3. The Framework

Introduction

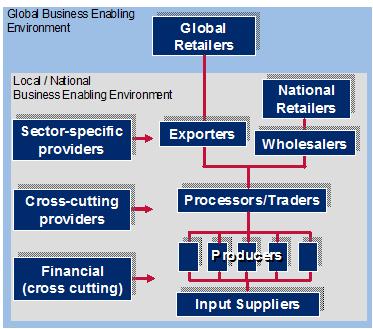

Value chains encompass the full range of activities and services required to bring a product or service from its conception to sale in its final markets—whether local, national, regional or global. Value chains include input suppliers, producers, processors and buyers. They are supported by a range of technical, business and financial service providers. Value chains have both structural and dynamic components. The structure of the value chain influences the dynamics of firm behavior and these dynamics influence how well the value chain performs. The process of chain analysis requires the use of the value chain framework to identify: 1) the structure of the chain, including all individuals and firms that conduct business by adding value and helping move the product toward the end markets, and 2) the dynamics of the value chain, which refers to the determinants of individual and firm behavior and their effect on the functioning of the chain.

For a more expanded model that expresses the broader context for value chains, see the inclusive market systems framework here.

Structural Factors

Image

The structure of a value chain includes all the firms in the chain and can be characterized in terms of five elements described below:

End markets: End markets are the starting point of the value chain analysis. End markets are people, not a location. They determine the characteristics—including price, quality, quantity and timing—of a successful product or service. End market buyers are a powerful voice and incentive for change. They are important sources of demand information, can transmit learning, and in some cases are willing to invest in firms further down the chain. End-market analysis assesses current and potential market opportunities through interviews with current and potential buyers, and takes into consideration trends, prospective competitors and other dynamic factors. During chain analysis, the focus should be on the current and potential production capacity of the chain in the country studied and its ability to respond to end market demand. It is through the analysis of end markets that we are able to identify the investment needs that will drive chain upgrading.

Business enabling environment: Chains operate in a business enabling environment (BEE) that can be all at once global, national and local and includes norms and customs, laws, regulations, policies, international trade agreements and public infrastructure (roads, electricity, etc.). The international enabling environment requires the investigation of conventions, treaties, agreements and market standards. While trade agreements, such as the Lomé Convention or AGOA, can open opportunities for firms, international standards such as GLOBALGAP and USDA’s APHIS program can build obstacles to the same opportunities. Information is also needed at other levels, including national and local policies, duties, business licensing procedures, enacted regulations and the state of public infrastructure. The analysis may need to be further broken down in terms of firm size: there may be particular constraints and opportunities facing micro- and small enterprises (MSEs), for example. Overall, the analysis process must determine whether and how the business enabling environment facilitates or hinders performance of the value chain, and if it hinders, where and how can it be improved. BEE constraints can be difficult to resolve—sometimes requiring considerable time, resources and political capital. Consequently, significant BEE constraints discovered during the value chain analysis phase may lead to a reconsideration of the selection of the value chain.

Vertical linkages: Linkages between firms at different levels of the value chain are critical for moving a product or service to the end market. Vertical cooperation reflects the quality of relationships among vertically linked firms up and down the value chain. More efficient transactions among firms that are vertically related in a value chain increase the competitiveness of the entire industry. In addition, vertical linkages facilitate the delivery of benefits and embedded services and the transference of skills and information between firms up and down the chain. MSEs are vertically linked to a varied range of market actors including wholesalers, retailers, exporters, traders, middlemen, input dealers, suppliers, service providers and others. The nature of vertical linkages—including the volume and quality of information and services disseminated—often defines and determines the benefit distribution along the chain and creates incentives for, or constrains, upgrading, defined as “innovation to increase value added.” Moreover, the efficiency of the transactions between vertically linked firms in a value chain affects the competitiveness of the entire industry. An important part of value chain analysis is the identification of weak or missing vertical linkages.

Horizontal linkages: Horizontal linkages—both formal as well as informal—between firms at all levels in a value chain can reduce transaction costs, create economies of scale, and contribute to the increased efficiency and competitiveness of an industry. In addition to lowering the cost of inputs and services, horizontal linkages can contribute to shared skills and resources and enhance product quality through common production standards. Such linkages also facilitate collective learning and risk sharing, while increasing the potential for upgrading and innovation. Value chain analysis also considers competition between firms. While cooperation can help firms achieve economies of scale and overcome common constraints to pursue opportunities, competition can encourage innovation and drives firms to upgrade. The most successful horizontal linkages maintain a balance between these two contrasting, but critical and complementary concepts. One of the objectives of value chain analysis is to identify areas where collaborative bargaining power could reduce the cost or increase the benefits to small firms operating in the chain.

Supporting markets: Supporting markets play an important role in firm upgrading. They include financial services; cross-cutting services such as business consulting, legal advice and telecommunications; and sector-specific services, for example, irrigation equipment or handicraft design services. Not all services can be provided as embedded services by value chain actors, and so vibrant supporting markets are often essential to competitiveness. Service providers may include for-profit firms and individuals as well as publicly funded institutions and agencies. Support markets operate within their own value chain—most service providers themselves need supplies, training and financing in addition to strong vertical and horizontal linkages. Value chain analysis should therefore seek to identify opportunities for improved access to services for target value chain actors in such a way that the support markets will be simultaneously strengthened, rather than undermined. Formal supporting markets are likely to expand as the value chain develops. Therefore, when analyzing emerging value chains, or ones predominated by MSEs, particular care should be taken to uncover informal sector service providers, which often go unnoticed.

Dynamic Factors

The firms in an industry create the dynamic elements described below through the choices they make in response to the value chain structure.

Value chain governance: A distinguishing characteristic of value chain analysis is the emphasis not only on the dynamics of end markets but also on the dynamics and shifts in relationships. Value chain governance refers to the relationships among the buyers, sellers, service providers and regulatory institutions that operate within or influence the range of activities required to bring a product or service from inception to its end use. Governance is about power and the ability to exert control along the chain – at any point in the chain, some firm (or organization or institution) sets and/or enforces parameters under which others in the chain operate. Understanding how and when lead firms set, monitor and enforce rules and standards can help MSEs and other firms in the chain better integrate and coordinate their activities. Governance is particularly important for the generation, transfer and diffusion of knowledge leading to innovation, which enables firms to improve their performance and sustain competitive advantage. Awareness of the governance structure of a value chain can provide governments, donors and development practitioners with information about how best to provide MSEs with the training and technical assistance needed to upgrade their position in the chain. When conducting value chain analysis, the type of governance structure that exists must be identified since it will contribute significantly to the selection of interventions to increase competitiveness.

Inter-firm relationships: This refers to the nature and quality of the interactions between stakeholders in a value chain. Relationships can be supportive of industry competitiveness that enhances MSE benefits or adversarial to it. Supportive relationships facilitate collaboration; enable the transmission of information, skills and services; and provide incentives for upgrading. They are based on a long-term view of the industry, while adversarial relationships are structured to maximize short-term profits. During value chain analysis interviewees should be asked questions that will reveal whether they consider their relationships to be mutually beneficial; whether their interactions are recurrent and substantial (involving the exchange of information, skills and services in addition to product and money) or are brief, isolated commercial interactions; and whether these relationships are entered into freely from a motive of self-interest, without social or government pressure.

Upgrading: In order to respond effectively to market opportunities, firms and industries need to innovate to add value to products or services and to make production and marketing processes more efficient. These activities, known as firm-level upgrading, can provide MSEs with higher returns and a steady, more secure income through the development of knowledge and the ability to respond to changing market conditions. Upgrading at the industry-level focuses on increasing the competitiveness of all activities involved in the production, processing and/or marketing of a product or service and mitigating the constraints that limit value chain performance. Upgrading needs to be a continual process and can leads to national economic growth. In value chain analysis, the objective is to identify opportunities and constraints to firm- and industry-level upgrading; specifically the analysis looks for catalyst firms with the incentives, resources and willingness to promote and facilitate upgrading within the chain.