Working with the Private Sector for Systemic Change: What Has (and Hasn’t) Our Partnership Facility Done for Us?

Image

This is the third post in a series by Dan Langfitt discussing partnership principles and partnership implementation. This series explores how a partnership facility can work as an interface between donor-funded programs and their private-sector partners, and how the partnerships that emerge can be an engine driving systemic change. Check out the first, second, and fourth posts on Marketlinks.

In 2017 and 2018, we started helping the private sector in Mozambique to take risks with business innovations with potential for transformational change. But we, too, needed to innovate in our approach to managing partnerships. (The FTF Agricultural Innovations (Inova)* team takes its name seriously!) In two previous posts, we wrote about why we created a partnership facility and described the tools and processes we used to create a space for more effective collaboration with the private sector.

In just the past year, we tested 12 innovations across 45 partnerships, and our partners committed over $1M to testing innovations that have begun to reach over 13,000 smallholder farmers. We now have a portfolio of partners that positions us to deepen our most promising work and spread the word about innovations that are already showing signs of success.

This post explores what we learned since we began using the first complete iteration of our partnership facility. At the end, we share some of the adaptations we have in mind for the next two years.

What did Inova learn this year about its partnership facility?

In some ways, our partnership facility helped us achieve what we set out to do. It gave us a way to bring together diverse perspectives and working styles, it mainstreamed good facilitation and management principles, and it helped us implement a flexible and adaptable donor-funded project. At the same time, it reminded us that a management system on its own doesn’t change behaviors, and it sometimes even worked against some of our principles.

Here are some of the things we learned this year about what our partnership did (and didn’t) do:

Image

Some reflections on flexibility…

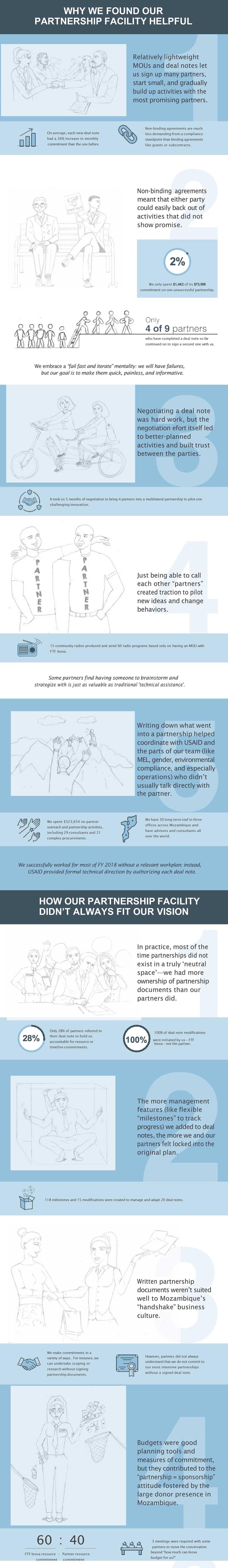

Since we adopted a probe–sense–respond approach to complexity as the conceptual anchor for dealing with the unpredictability we faced in Mozambique’s thin agricultural market system, if it did anything, our partnership facility needed to give us flexibility without losing sight of what we wanted to learn. And in many cases, it did—for us, it is a success when a partnership falls flat and we learn why it didn’t work at the price of just 2% of the partnership budget. Being able to fail fast gave us the flexibility to start with small, sometimes risky partnerships and gradually build a sturdy portfolio of activities.

On the other hand, while we had rules for when to formally change a deal note—such as to add activities, extend the calendar, or significantly change either partners’ contribution—we still struggled with how comprehensive to make them. The concept of a deal note ‘modification’, taken straight from the realm of contracts and grants, felt unnatural to partners and our teammates alike since they were inherently fluid. We signed deal notes to experiment and learn new things, so most deal notes became outdated as soon as they began.

A handful of policies and templates, no matter how well-intentioned, wasn’t going to change prevailing beliefs and behaviors—at least, not all at once. The amount of detail we put into a partnership could shift our focus away from adaptation and creativity towards tracking budgets and implementation calendars. Even if a tactic (or even the whole partnership) wasn’t working, we might already have equipment procurement in process, a consultant getting on a plane, and groups of expectant farmers. Our non-binding agreements gave us the administrative ability to adapt quickly, but that didn’t combat the ‘sunk cost’ fallacy on its own or create the cognitive flexibility we needed. Overcoming these biases demanded strong management skills from the team.

...and relationships:

In addition to giving a structure to our adaptive approach (with the contradictions inherent in “formalizing flexibility”), our approach built strong relationships. For example, we were surprised by the traction that calling each other “partners” often created with just an MOU, before we even provided traditional technical assistance. And although deal notes are not as administratively rigorous as binding agreements like grants or subcontracts, writing them was no picnic. We sometimes spent three, four or five months just planning and negotiating an activity that might only last for six. However, by the time we signed the deal note, we had built trust with our partner and between other market actors involved in the activity and learned more about each other. All that planning not only helped avert obstacles during implementation; it prepared us to work together to overcome them.

On the other hand, Mozambique’s prevalent “handshake” culture did not line up well with our approach’s focus on written documents. In that sense, our MOUs and deal notes weren’t suited to how our partners were used to formalizing relationships. Moreover, having only two flavors of partnerships—lightweight MOUs and activity-intensive deal notes—meant that a medium-intensity partnership might end up under-resourced with an MOU or over-managed through a deal note. This misalignment contributed to FTF Inova owning most partnerships more than partners did. We did not achieve our ideal of placing our partnership ‘engine’ in a truly neutral space—at least, not yet.

None of the advantages or weaknesses of our approach were consistent across all of our partners, though. For example, even though we were disappointed by the lack of ownership most of our partners expressed around the partnership documents themselves, three of them scrutinized the deal note budgets closely and held themselves—and us—accountable for the activity timelines. And just as we saw variation across partners, we know that things may change over time.

What’s next for FTF Inova and its approach to partnerships?

As we look forward to the next two years, we are adapting our partnership facility to help us deepen and broaden our work to start to reach scale in different ways. We will need a spectrum of partnerships to do this, from intensive ones to generate deep behavior change to light-touch but strategic ones focused on spreading the word about proven innovations and creating competitive pressure to adopt them. We will also need to leverage the credibility we’ve earned to bring together coalitions of market actors to forge partnerships that will outlive FTF Inova.

Some adaptations we are considering for this year include:

- Creating a partnership mechanism that is well suited for planning and managing activities that don’t require large budgets, so that we can have the coordination benefits of a deal note without the administrative elements that sometimes set the team on a more rigid path.

- Developing a methodology for formulating partnerships between multiple market actors, since part of the legacy we want to leave is of a more connected, trusting market system.

- Making better use of our existing partnership tools, like tying deal note milestones to the next step in a partnership, or strategizing further in advance to use grants strategically to accomplish partnership objectives.

- Finding ways to encourage more creativity through changes to the small, day-to-day incentives that our partnership procedures create—for example, hiring dedicated coordinators supporting partnership administration so our portfolio managers can focus on the relationship and a flexible vision.

One thing we keep in mind as we adjust our approach to partnership management is the trade-offs we make. The next post in this series will take a step back and reflect on the trade-offs for MSD programs to consider when designing a partnership facility.

Please contact Dan_Langfitt@DAI.com and Luca_Crudeli@DAI.com for more information about FTF Inova and its partnership approach or to share your feedback.

_______________________________________________

We want to share some of FTF Inova’s partnership resources with the community! The tools in the resources bar below may not be the right fit for your team or the work it is doing—the skill sets of each team and its working environment vary—but if you do find them helpful, and especially if you adopt and adapt them, we hope you will share your experiences with us.