What We Talk About When We Talk About Blended Finance

Image

In March, Marketlinks is exploring Blended Finance. This blog provides an overview of this topic from the USAID INVEST project. We welcome your submissions. If you have a resource, case study, or blog to contribute to this topic, please help us share with the Marketlinks learning community. Upload your content from the 'post' button on the home page or send us an info@marketlinks.org to get started.

The following post draws heavily from resources produced by Convergence, in particular Who Is the Private Sector?

This post was authored by Emily Langhorne, INVEST Communications Specialist.

In 2015, the United Nations developed the Sustainable Development Goals (SDGs)—a global checklist of objectives designed to ensure the sustainable development of our world and the prosperity of its people. Unfortunately, the annual funding gap for reaching the SDGs by 2030 is trillions per year—a figure that vastly exceeds the resources of development agencies. After all, official development assistance from government aid worldwide is only about $150 billion a year.[i]

Shortly afterwards, the U.S. Agency for International Development (USAID) reoriented its policy framework around using foreign assistance funding to support developing countries on their Journey to Self-Reliance, defined as their capacity to plan, finance, and implement sustainable solutions to their development challenges.

Achieving self-reliance goes hand-in-hand with progressing towards the Sustainable Development Goals, and engaging the private sector is an integral component for the success of both agendas. Closing the SDG funding gap will require mobilizing the world’s largest financing pools—private capital, and a country’s journey to self-reliance requires the development of its private sector and the deepening of local financial markets.

Unfortunately, many developing countries have unattractive investment climates that negatively affect the appetite of banks, institutions, and individuals to lend to and invest in businesses operating in their jurisdiction. Numerous barriers prevent capital flows into these markets, including: weak liquidity, high market volatility, exchange rate fluctuations, the small size of individual investment opportunities, and potential investors’ lack of familiarity.[ii]

Here, however, international development agencies can help. They can encourage private investment in development countries through blended finance interventions.

Blended finance is the strategic use of development funds, such as those from government aid and philanthropic sources, to mobilize private capital for social and environment results, such as improving infrastructure, education, agriculture, healthcare, and more.

Good blended finance transactions not only mitigate investment risks and align private capital with immediate development needs, but they also have a positive long-term impact on local financial ecosystems—an important stepping stone on a country’s path to self-reliance. Because blended finance centers on improving risk-adjusted returns, it also helps increase the number of investment opportunities for the private sector in developing countries. Furthermore, by drawing in private capital, blended finance interventions ultimately allow international development agencies to make progress beyond what they could achieve with their own limited budgets.

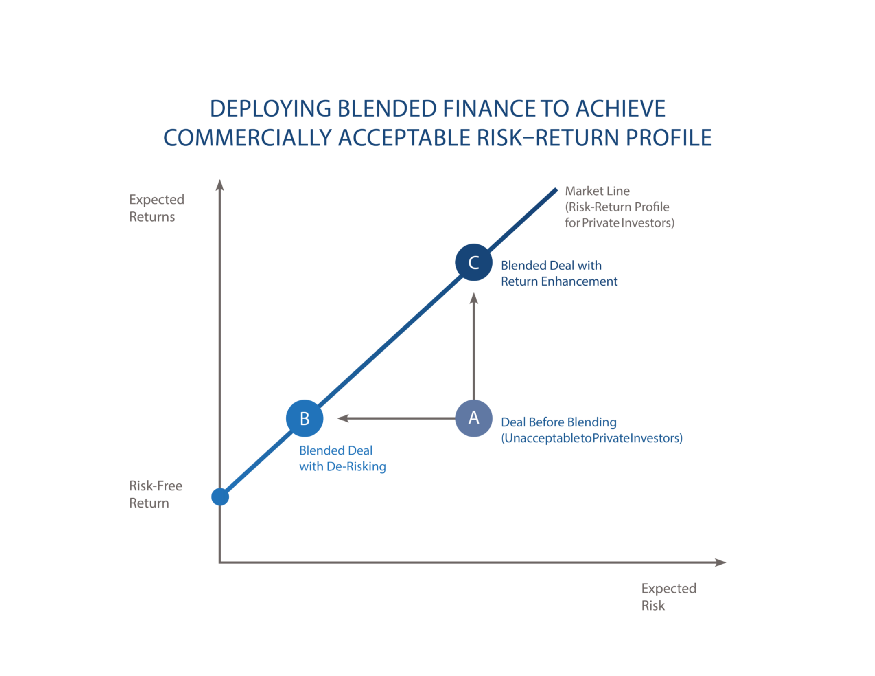

Blended finance interventions aim to create both financial returns and positive social and environmental outcomes. Described simply, these interventions enhance an investment’s potential return—the money it makes over time—relative to its risk factor—the possibility of incurring a financial loss instead of a return. In other words, they improve the investment’s risk-adjusted return, thereby making it more attractive to investors. [iii] Risk-adjusted returns are an important factor in an investor’s decision to invest in an activity, fund, company, etc. If two investment opportunities have the same anticipated return over the same duration of time, the one that has the lower risk will have the better risk-adjusted return, making it the more likely choice for investment.[iv]

All investments incur some level of risk; however, investments in developing countries often present additional risks. While these countries often have attractive investment features that developed economies lack, such as high yields, fast-growing economies, and uncorrelated markets, if the risk-adjusted returns aren’t as attractive as the investment options in other markets, commercial investors won’t invest money into these opportunities.[v]

By improving the risk-adjusted returns of transactions in these markets, international development agencies alongside other public and philanthropic actors can drive commercial investment into markets, sectors, projects, or companies that the private sector would not otherwise consider.

While blended finance transactions are usually complex, development agencies often rely on a few fundamental interventions to support them.

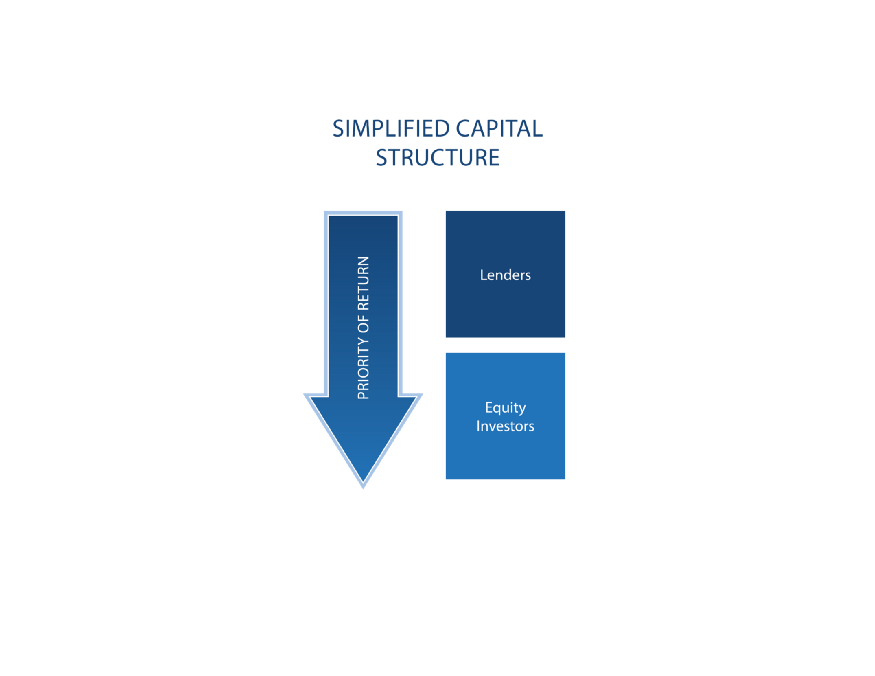

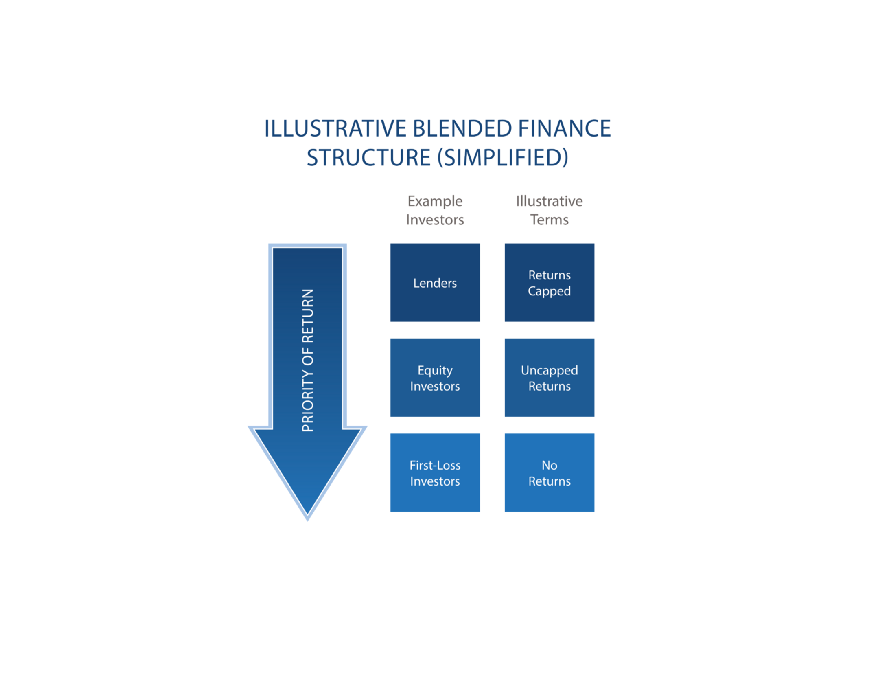

One intervention is to participate in the deal structure. Structuring is the combining of different types of capital, risk mitigation, and incentives to attract investors and appropriately fund an investment. Capital structure in blended finance refers to the specific combination of debt, equity, and grant funding used to finance an investment as well as the priority of investors and lenders in terms of absorbing losses and earning a return.[i]

Debt and equity are the two main ways to raise money for an investment. By taking on debt, the borrower owes another party money, pays interest to borrow that money, and has a defined repayment schedule. By taking on equity investments, the investee is allowing an outside party to take partial ownership of the company. Lenders who issue debt are paid back before equity investors gain profits, so lenders take on less risk than equity investors. For this reason, equity investors expect a higher rate of return and more control over the investment. However, unlike debt, equity investments do not have to be paid back, which can be helpful if a firm encounters a period of declining earnings.[i]

An example of how international development agencies can participate in a deal is by injecting catalytic (aka concessional) into its structure. Catalytic capital is financing that has terms more favorable than those set by the market; for example, it may have low or no interest, grace periods, or long payback timelines.[i] Development agencies can also contribute catalytic capital in the form of grant-like capital for which there is no expected payback. By contributing a new layer of capital into the structure, development agencies can absorb lower returns or the first financial losses, thereby protecting the returns of private sector partners if the investment does not turn out as forecasted.[ii] Ultimately, the presence of catalytic capital helps de-risk investments and create the appropriate risk/returns required to crowd in private sector investors.

An example of how international development agencies can participate in a deal is by injecting catalytic (aka concessional) into its structure. Catalytic capital is financing that has terms more favorable than those set by the market; for example, it may have low or no interest, grace periods, or long payback timelines.[ii] Development agencies can also contribute catalytic capital in the form of grant-like capital for which there is no expected payback. By contributing a new layer of capital into the structure, development agencies can absorb lower returns or the first financial losses, thereby protecting the returns of private sector partners if the investment does not turn out as forecasted.[iii] Ultimately, the presence of catalytic capital helps de-risk investments and create the appropriate risk/returns required to crowd in private sector investors.

Blended finance interventions do not always require development agencies to participate in the deal structure. Instead, they can improve an investment’s risk-adjusted returns via other approaches, including the financing of technical assistance such as sidecar facilities and transaction advisory services. Financing a fund’s technical assistance sidecar creates a facility through which fund managers can provide portfolio companies with business advisory services, thereby decreasing the risk associated with investing in these companies. Similarly, the lack of transaction advisors in emerging markets often creates barriers that prevent private capital from entering these markets. By covering the fees of transaction advisors, development agencies can incentivize them to work on deals in emerging markets that they would otherwise avoid because these markets tend to be riskier and less profitable than developed markets.

Other blended finance approaches that development agencies use include providing a guarantee to lenders in the case of losses, purchasing insurance against certain risks, or assisting in the development of a project so that its fruition appeals to private sector actors and simultaneously has social and environmental benefits.[i]

Blended finance aims to make development spending more catalytic, meaning that for every public or philanthropic dollar spent on a development project, additional dollars in private capital are mobilized to invest alongside it, ultimately increasing social and environmental impact. As such, all blended finance transactions should have three signature markings that demonstrate the alignment of private and development interests: impact, returns, and additionality.[ii]

Impact illustrates the ways in which the investee or investable project contributes to sustainable development in a developing country. Returns demonstrate that the transaction is expected to generate a profit. Additionality offers proof that the international development agency’s intervention (catalytic capital, insurance, technical assistance, etc.) generated meaningful private sector participation that wouldn’t have happened otherwise. If private capital would have entered the deal (at the same value and with the same conditions or time frame) without the international development agency’s involvement, then there is little to no additionality.[iii]

Additionality provides the rationale for pursuing blended finance strategies. Without evidence that blended finance helps secure additional financing or improves a project’s development results, development agencies run the risk of wasting resources on transactions and projects that would have been equally successful without their involvement.[iv] The worst-case scenario is that their resources “crowd out” private capital that would have come naturally into the transaction had the development agency not stepped in to fill an assumed void.

Unfortunately, additionality is difficult to prove because blended finance transactions do not function like science experiments that carefully compare an intervention against a control group. No alternative transaction exists to quantify the amount of money that would have been raised without the intervention. Likewise, a project can’t quantify how successful or unsuccessful it would have been had additional private capital not been mobilized.[v]

Often international development agencies report leverage ratios for blended finance: the amount of commercial financing mobilized by development capital using blended finance.[vi]

In general, leverage usually equates to the amount of commercial capital (at market terms) divided by the catalytic or concessional capital. However, the blended finance ecosystem lacks a universal methodology for calculating leverage ratios, which makes comparing ratios from multiple sources difficult.[vii] Every individual transaction has a different risk profile based on the sector and market, and different interventions produce different leverage ratios even if used in the same market or sector. All these factors make comparing leverage ratios across different blended finance transactions challenging.[viii]

The relationship between leverage ratios and additionality is also a complicated one. At face-value, high leverage ratios seem positive because they show a significant amount of private capital spent per donor dollar. However, high leverage ratios can underscore that the blended finance intervention was not truly needed.[ix] For instance, if a deal attracts a significant number of high-value, private sector investments, then it’s possible that it would have attracted commercial investments without development agency participation. Blended finance transactions with lower mobilization can be shown to have high additionality because they reveal that a development agency influenced commercial investment in an area with significant risks but high social or environmental returns (e.g., investing in conflict-affected areas or least developed countries).[x] Thus, high leverage ratios may actually be at odds with additionality, signifying an unnecessary blended finance intervention, rather than a successful one.

*Illustrations based on graphics created and produced by Convergence.

References

[i] OECD, “NET ODA,” Data, 2019, https://data.oecd.org/oda/net-oda.htm.

[ii] The Blended Finance Taskforce, “Better Financing, Better World: Consultation Paper of the Blended Finance Taskforce,” (London, United Kingdom: Nov. 9 2018). http://s3.amazonaws.com/aws-bsdc/BFT_BetterFinance_final_01192018.pdf#asset:614:url.

[iii] Convergence, “Who is the Private Sector? Key Considerations for Mobilizing Institutional Capital Through Blended Finance,” Jan. 2018, https://www.convergence.finance/resource/1hYbzLsUbAYmS4syyWuqm6/view.

[iv] James Chen, “Risk-Adjusted Return,” Investopedia, Dec. 20 2018, https://www.investopedia.com/terms/r/riskadjustedreturn.asp.

[v] Convergence and USAID INVEST, “Blended Finance Workshop for USAID PIVOT Champions.” PowerPoint presentation presented in Baltimore, MD, Sept. 4 2019.

[i] Alicia Touvila, “Capital Structure,” Investopedia, Oct. 24 2019, https://www.investopedia.com/terms/c/capitalstructure.asp.

[i] Laura Iruegas, “Blended Finance Jargon Buster,” Convergence, 18 Sept. 2019, https://www.convergence.finance/news-and-events/news/4iJAtdNIAelZLSTnDuCEz9/view.

[ii] Convergence, “Bridging the Linguistics Gap: Common Terms Defined Differently by USAID and Investors,” Presented at PIVOT In-Person Meeting 3, Dec. 2 2019.

[i] J.B. Maverick, “Equity Financing vs. Debt Financing: What’s the Difference?” Investopedia, Apr. 19 2019, https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp.

[i] J.B. Maverick, “Equity Financing vs. Debt Financing: What’s the Difference?” Investopedia, Apr. 19 2019, https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp.

[ii] Laura Iruegas, “Blended Finance Jargon Buster,” Convergence, 18 Sept. 2019, https://www.convergence.finance/news-and-events/news/4iJAtdNIAelZLSTnDuCEz9/view.

[iii] Convergence, “Bridging the Linguistics Gap: Common Terms Defined Differently by USAID and Investors,” Presented at PIVOT In-Person Meeting 3, Dec. 2 2019.

[i] The Blended Finance Taskforce, “Better Financing, Better World: Consultation Paper of the Blended Finance Taskforce.”

[ii] Convergence and USAID INVEST, “Blended Finance Workshop for USAID PIVOT Champions.”

[iii] Ibid.

[iv] OECD, “Workshop Report: The Next Step in Blended Finance: Addressing the Evidence Gap in Development Performance and Results,” Oct. 22 2018, https://www.oecd.org/dac/financing-sustainable-development/development-finance-topics/OECD-Blended%20Finance-Evidence-Gap-report.pdf.

[v] Ibid.

[vi] Convergence, “What Is Leverage in Blended Finance?”, YouTube Video, 1 minute 35 seconds, Sept. 18, 2019, https://www.youtube.com/watch?v=51fTfK2R6kA.

[vii] Ibid; Javier Pereira, “Blended Finance: What is it, how it works and how it is used,” Oxfam International, Feb. 13 2017, https://www.oxfam.org/en/research/blended-finance-what-it-how-it-works-and-how-it-used.

[viii] Convergence and USAID INVEST, “Blended Finance Workshop for USAID PIVOT Champions.”

[ix] The Blended Finance Taskforce, “Better Financing, Better World: Consultation Paper of the Blended Finance Taskforce.”

[x] Ibid.