A Month on the Trail – Hot, Dusty and Dry: A Primer on Finance

It’s been a month now, and we’ve just reached the juncture of the north and south forks of the Platte. As they say, it’s a mile wide and foot deep – too thin to plow but too muddy to drink. From here, we’ll remove the wheels from the wagons, caulk them as best we can, and float them across. Then we’ll leave the Platte Valley and drop down into Ash Hollow, where we’ll be able to rest with shade and fresh water. At that point, our journey will be about a third complete.

The days are starting to heat up (and tempers, too). Last week, our water ran low, so we had to begin rationing supplies. A fight broke out yesterday when Old Man Forsythe accused one of the children of taking beyond her share, and her pa took umbrage. Forsythe sure is a crusty old fellow!

The days are starting to heat up (and tempers, too). Last week, our water ran low, so we had to begin rationing supplies. A fight broke out yesterday when Old Man Forsythe accused one of the children of taking beyond her share, and her pa took umbrage. Forsythe sure is a crusty old fellow!

But we continue to make about 15-20 miles a day, and there are plenty of beans and buffalo meat to keep us fed. Last night, the young folks broke out a fiddle and had a fine time around the campfire. Word is that the Johnsons’ daughter, Caroline, has her cap set on young Jake, the scout. She could do worse.

When we last checked in, we talked about the different approaches to assist with private capital mobilization (risk mitigation, project preparation, enabling environment, etc.). Today we want to fill in some background and unpack what we mean by “finance” and the ecosystem in which it takes place. And, we have a surprise in store: At the very end of these two posts (after the vignettes), we will reveal, in one sentence, what it is that financial intermediaries do all day.

Finance is a transformative process in which savings are gathered, bundled, and converted into capital. Capital is then allocated through financial intermediaries and/or markets in the form of financing (broadly speaking either as an investment or a loan). That financing, in turn, funds the capital investments that drive economic growth (that in turn reduce poverty and further other development objectives, such as improved health care, food security, and increased access to clean energy).

In short, finance performs two functions which are indispensable to economic growth:

- It mobilizes and pools savings in the form of capital.

- It allocates that capital (primarily through pricing) to the most productive investments (by definition, those with the highest return relative to risk).

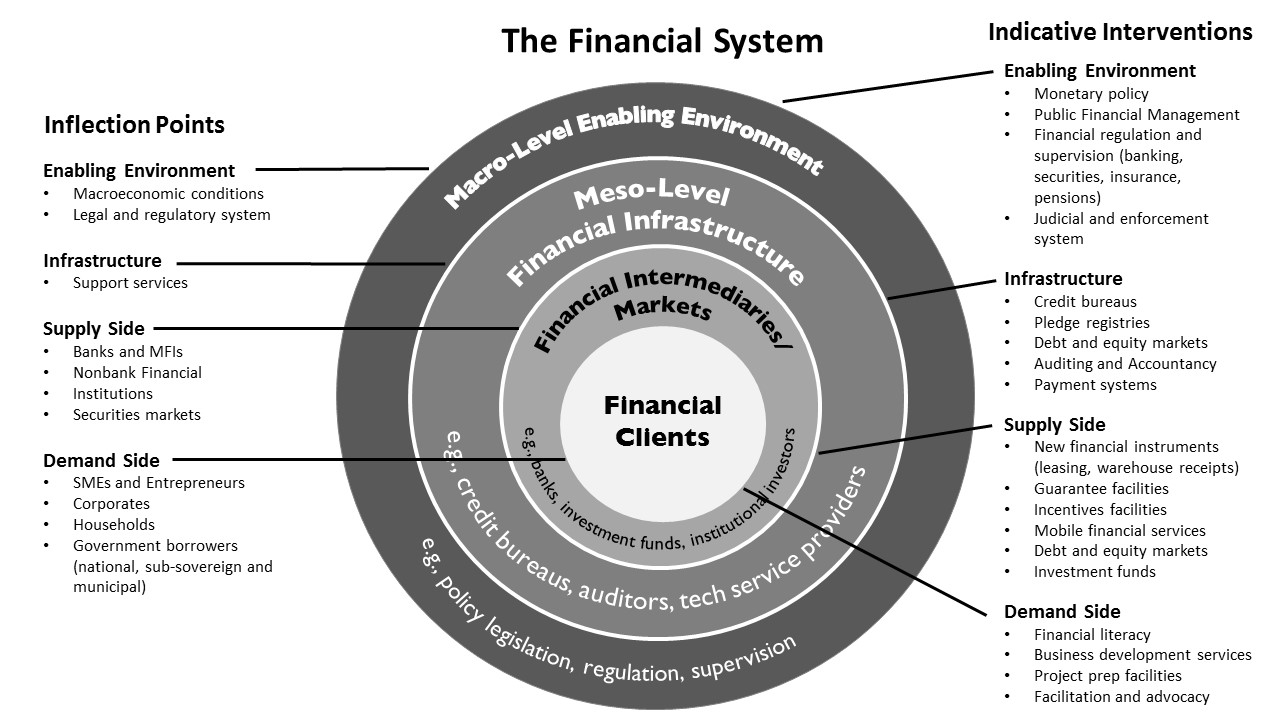

The financial system is the “ecosystem” of oversight institutions, supporting infrastructure services and instruments, intermediaries and markets through which finance is conducted. It ranges from the legal, regulatory, and institutional framework that governs transactions to be made to the actual extension and collection of credit.

Financial intermediaries are the middlemen engaged in mobilizing and allocating capital – including MFIs, commercial banks, investment banks, securities markets, brokers, insurance companies, pension funds, etc.

Now that we have mastered finance and the system in which it operates, we turn to the vignettes. Our first is from Amanda Fernandez of Carana. It demonstrates a promising and very different approach being implemented in Ghana that uses pay-for-performance incentives to stimulate commercial financing for agriculture-related investments.

Stimulating Finance for Feed the Future Value Chains through Incentive Grants

The challenge: Encourage Ghanaian partner financial institutions (PFIs) of all sizes to quickly expand financing for loans to invest in the Feed the Future agricultural value chains of the north. Historically, these institutions have been reluctant to make agriculture-related loans, due to their lack of understanding of the opportunities and risks as well as high transaction costs. Ensuring that the value chain was built to absorb increased production was critical to the success of the Feed the Future effort.

The solution: USAID’s Financing Ghanaian Agriculture Project (FinGAP) identified agribusiness opportunities in the north, provided training, and released an innovative RFA inviting all Ghanaian PFIs (banks, MFIs, equity funds, etc.) and others to bid for pay-for-performance awards (essentially incentives) which they would need to begin financing for specific value chain investments in the north. Payments would be made against evidence of loans disbursed.

How it mobilized private capital: Grant agreements were signed with the winning institutions in January 2015. By May, banks had released $4.8M in new financing for the targeted value chains. USAID will pay $180,000 in incentive grants, effectively leveraging USAID grant resources 26:1. A total of $31.4M in new financing is in the pipeline for release by PFIs before December 2015, of which USAID will reimburse $1.3M.

How it was inclusive: A wide range of PFIs participate in the incentive grant program: from small, rural community banks with predominantly female and smallholder farmer microenterprise clients to large banks serving SMEs and corporate clients. Value chain investments will have broad benefit to the farmers in the targeted value chains of the north.

How it was innovative: Similar grants to PFIs had never been attempted before, and one key innovation was that PFIs competed to participate (thereby pushing down the incentive payments required).

Lessons learned: Cash is indeed king and can be effective in “lighting a fire” under PFIs to prioritize activities differently and channel increased financing to underserved value chains.

This vignette was submitted by Amanda Fernandez (afernandez@carana.com), USAID-FinGAP Case Leader. For more information on this project, contact Amanda or Rick Dvorin (rdvorin@carana.com), Chief of Party of the USAID-FinGAP project.

Next up: Making Camp: Two More Vignettes to Ponder Overnight