The Market Corner: Elevating Environmental and Social Justice Returns on Investment

Image

This month, the Market Corner sits down with two impact investing experts, Sana Kapadia from GenderSmart Investing and Rory Moses, an independent consultant most recently with the G7 Impact Taskforce and previously Associate Director at Palladium Impact Capital. In this month’s first installment of the series, the Market Corner examines where the impact investing field is headed, and the role that systems thinking can play in accelerating that journey.

Increasing interest in deep impact investing

The momentum around impact investing in the last few years has been impressive, says Rory. He and Sana have both observed a growing group of investors, ranging from philanthropic to institutional, seeking to direct their economic power in the service of deeper impact, including environmental and social justice.

Image

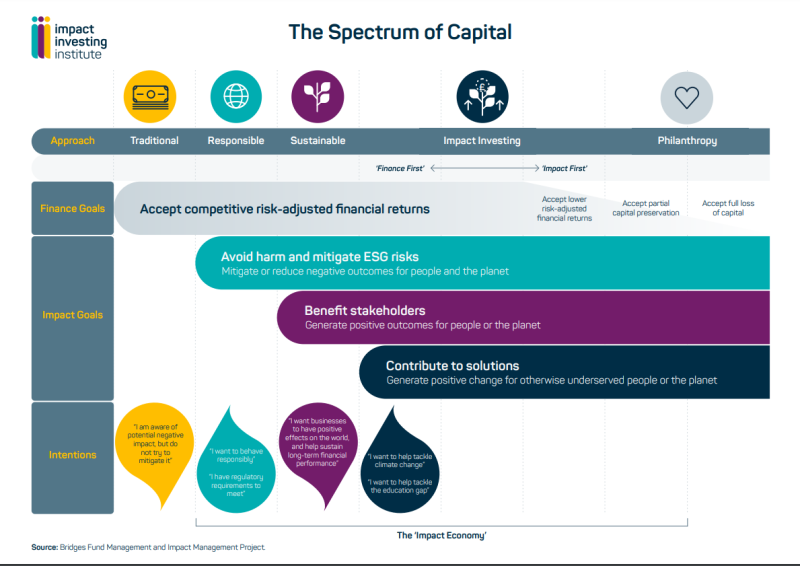

These investors ask, “Are we investing to improve the very system that has produced the current problems or merely treating certain symptoms?” They are seeking approaches which go beyond responsible and sustainable investment to those that tackle systemic barriers and catalyze large-scale, sustainable, and positive change without unleashing negative unintended consequences.

“No just and durable solution can come from traditional investment alone.” – Rory Moses

Systems change investing and Justice, Equity, Diversity and Inclusion (JEDI) investing are two examples of these vanguard approaches. A systems change approach recognizes the complexity of the systems in which we operate and shifts the focus of investing in companies generating a social impact return to portfolios of investments which address the root causes of injustice and inequality.

JEDI investing also takes a systems lens. It is about understanding the systemic biases and barriers which influence who is investing, who receives investment, which investments make it into portfolios, how investments are structured, and how all those decisions are made. This approach builds upon the momentum of Gender Lens Investing. JEDI investing showcases the interconnected nature of current gender, race, other forms of diversity, and socio-economic divides and seeks to address inherent unequal power dynamics within finance.

On the spectrum of capital, systems change investing is on the far end of the spectrum, further right than sustainable and impact investing. In contrast, a JEDI investing lens can be applied across approaches and asset classes.

A systems lens for investing makes you think about underlying power and entrenched dynamics

These approaches represent a broader movement of investors that want to understand power dynamics within the whole system and are mandated to identify high yielding leverage points through which durable, equitable, and positive change can be achieved.

Image

According to Sana, “A first step in systems thinking and its implications on investing is about being aware and acknowledging that our existing financial and wider economic systems have bias and privilege baked into [them]. This stems from the historical and political contexts, with localized nuances and impacts.” She believes that a systems lens offers a way to see different entry points and ways to leverage one’s own power within the system.

“A JEDI lens supports this thinking about the underlying systems of power and entrenched dynamics in existing financial systems that are holding back or not providing equal access to opportunity or capital for women and underserved groups.” – Sana Kapadia

As implied by the name, systems change investing also uses a systems lens. According to Rory, “Mapping and analyzing the system — its parts, relationships, and resulting behaviors — is essential. This mapping process allows the diverse stakeholders to forge a common future vision of a better functioning and more equitable ecosystem and elaborate the theory of change which outlines the journey from here to there.”

The Global Energy Alliance for People and Planet (GEAPP) is an example of investors using a systems change investing approach. The purpose of the GEAPP is to transform, at a national level, the supply and demand for renewable energy. GEAPP synergistically deploys its resources, both investment and grant capital, advocacy, policy engagement, technical expertise, and data to create ecosystems of projects which can be aggregated, replicated, and scaled to achieve change at a materially significant level.

Though far from mainstream, the momentum of systems change and JEDI investing, as well as other forms of deep impact investing approaches, is growing rapidly. These approaches are a clear response to the growing recognition that traditional investment or even investments targeting symptoms of inequitable systems are grossly insufficient.

This moment requires bolder and more holistic approaches that recognize the complexity of the systems in which they are trying to intervene and can overcome deep rooted biases within the sector, which is a topic that the Market Corner’s next installment will unpack. Though it may sound daunting, the starting point is within reach. It begins by having conversations with those actors currently implementing these strategies, and seeing how they can be adapted to different contexts and investment objectives.

Do you have examples of novel deep impact investing approaches or advice on how to get started with deep impact investing? Post via your Marketlinks account or just send them to us at info@marketlinks.org, and we may include them in the next installment of the blog!

Holly Lard Krueger is a managing partner at the Canopy Lab and a market systems development expert with over 15 years of experience providing technical advice in the field of private sector development/engagement with a specific focus on applying digital technology, gender equality and social inclusion (GESI), market systems, and Value for Money (VfM) principles to project and strategy design for agriculture, humanitarian aid, business enabling environment reform, trade, urban development, and women’s economic empowerment programs.

Holly is a proven strategic leader, having managed large market systems projects with diverse teams. She is also skilled as a strategic advisor, coach, and trainer in the practical application of systems approaches to market development, and she is currently an advisor to USAID’s Bureau for Humanitarian Assistance, a World Bank-funded program in West Africa (TFWA), a DFAT-funded program in Indonesia (PRISMA), and a FCDO-funded program in the Democratic Republic of the Congo (Essor). Holly is based in Morocco and has worked in over 15 countries in Africa, Asia, and the Middle East and has implemented projects and conducted evaluations for leading donors, including the Bill & Melinda Gates Foundation, DFAT, IFC, FCDO, USAID, and the World Bank. She has an M.A. from Johns Hopkins School of Advanced International Studies and a B.A. from Vanderbilt University.

Image

Rory Moses is an impact-focused investment advisor, specializing in private, emerging market, impact investment funds with experience across vehicle types and sectors, and a particular interest in climate vehicles with a focus on just transition. He is currently an independent consultant who most recently co-authored G7 Impact Taskforce report on mobilizing institutional capital towards the SDGs and a Just Transition. He also spent the last four years in impact investment banking as an Associate Director at Palladium Impact Capital (formerly Enclude Capital). He was previously a management consultant focused on growth strategies for financial institutions in Southern Africa. He has studied in South Africa, Germany, and the United Kingdom.

Image

Sana Kapadia is Head of Content at GenderSmart, where she develops programming for the global gender finance community. She leads the Justice, Equity, Diversity, and Inclusion Working Group and a Care Economy initiative. A gender-smart investing specialist and global changemaker, her career has spanned development finance, impact investing, and equity research. She has grown a social impact accelerator, advises on and implements effective blended finance solutions, and provides capacity building and advisory support around impact ecosystem building and embedding gender lens frameworks.