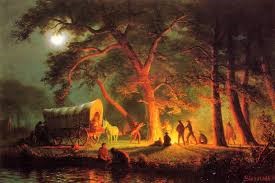

Making Camp: Two More Vignettes to Ponder Overnight

Let's c arry on from where we left off. The second vignette comes from Dennis Wesner at USAID/Timor-Leste. It’s an example of using a partial grant to help a local business solve its supply chain problem (and in the process, benefit farmers).

arry on from where we left off. The second vignette comes from Dennis Wesner at USAID/Timor-Leste. It’s an example of using a partial grant to help a local business solve its supply chain problem (and in the process, benefit farmers).

Encouraging Local Enterprises to Invest in Improving their Supply Chain

The challenge: Broken and non-existent links in the value chain contributed to low agricultural productivity in Timor-Leste. Farmers had no access to seeds and other inputs; transportation to market often occurred by wheelbarrow, and there were no cold storage options to reduce post-harvest loss.

The solution: The USAID/Timor-Leste’s Mission, through its DAI-implemented Developing Agricultural Communities (DAC) project, created a win-win solution by convening and recruiting private sector partners to solve their supply chain problem by investing in the farmers.

How it mobilized private capital: DAC convened and recruited four local partners (three grocery chains and an input supply company) to each contribute $1,000 per month for a total of $100,000 in private capital invested over the life of the project. These funds were used to provide inputs as well as to consolidate and transport the produce from farmer fields to markets.

How it was inclusive: The project directly benefited rural farmers who were able to increase their incomes by at least 100%, while also providing better quality produce to consumers in urban areas.

How it was innovative: The project played a convening role: it created shared value by bringing farmers together with end-market buyers (the grocery chains), and then convinced those grocery chains that an investment in upgrading their supply chain was in their economic interest.

Lessons learned: Private sector financing can be catalyzed in instances where shared value can be demonstrated. It can be generated at the local level (and not just from deep pocket partners). In this case, small, low-margin grocery stores were willing to invest because they benefited from the improved quality of the farmers’ produce, and, as a result, the farmers benefited as well.

This vignette was submitted by Dennis Wesner (dwesner@usaid.gov), Director of the Office of Economic Growth at USAID/Timor-Leste.

The third vignette comes from Cardno and provides another approach to partial grants, but in this case as “seed capital” or “free equity.” Question to ponder: If we are using our public funds as seed capital to launch businesses, is it possible to ask for a financial return on that capital if the business succeeds?

“Seed-Funding” to Stimulate Senior Credit

The challenge: Job creation is a key objective of the USAID Kosovo Mission, but many Kosovo-based businesses lack the ability to obtain the financing they need to grow and create new jobs.

The solution: The Kosovo EMPOWER Private Sector Project (2014-2019), implemented by Cardno, addressed the job creation challenge by forming a “Strategic Activities Fund” to invest in interventions that would stimulate new employment. EMPOWER’s grant funds function as a kind of “free equity,” providing the capital often needed at the bottom of a substantially larger financing package to “buy down” risk for senior lenders.

How it mobilized private capital: One typical case is a mid-sized furniture producer in Ferizaj, Kosovo, which has concluded a long-term contract with a German importer for children’s beds that will add over $1 million per year to its export sales and create 40 new jobs. The total cost of the expansion, mostly for production equipment, is about $400,000. A local bank has committed to providing a long-term loan of $325,000, conditioned on the company providing the additional amount in paid-in capital. EMPOWER will provide $75,000 in the form of a grant, making this financing package feasible. We anticipate that the $2 million fund will help leverage at least an additional $20 million in private capital financing.

How it was inclusive: The leveraged financing package will enable a factory expansion that will improve the incomes of approximately 100 families in central Kosovo, counting the jobs created both in the direct beneficiary SME and its suppliers, including women, youth, and ethnic minorities.

How it was innovative: The ability to provide “risk capital” – almost entirely absent in developing economies such as Kosovo – will make it possible for dynamic job-creating SMEs to leverage private finance for expansion.

Lessons learned: An early joint meeting of the company, the bank, and the assistance project’s business consultants is advisable to speed the process.

This vignette was submitted by Cardno's David King (David.King@cardno.com), Chief of Party for the USAID Kosovo EMPOWER Private Sector Project. For more information, please contact David or Carolina Ravinskas (carolina.ravinskas@cardno.com), Manager of Communications and Knowledge Management at Cardno.

Before we hit the bedroll, we promised to reveal the secret of what it is financial intermediaries do all day. Here it is in one sentence: They gather savings and other funds and pool them as capital; they assess and price the risk associated with financing opportunities for that capital; they structure financing instruments appropriate for those opportunities and the risk involved; and, finally, they either hold and manage those investments and loans or they allocate them to others.

Next up: Laying Up at Fort Laramie: Pricing and Mitigating Risk