Laying Up at Fort Laramie: Pricing and Mitigating Risk

After fifty long days on the trail, we finally reached Fort Laramie at sundown yesterday. The plan is to lay up for two days to make repairs and replenish supplies, and to then push on to the Wind River Range.

After fifty long days on the trail, we finally reached Fort Laramie at sundown yesterday. The plan is to lay up for two days to make repairs and replenish supplies, and to then push on to the Wind River Range.

They call Laramie the “crossroads to the west” – nigh every wagon train passes through here, whether bound for California, Utah, Montana or the Oregon Territory. Started as a trading post for trappers about 30 years ago, the Army eventually took it over and turned it into Cavalry fort.

And with hundreds of families camping here in their wagons, along with scores of Sioux, Cheyanne and Arapaho (and even a few of the old mountain men), Laramie is a lively place indeed!

The party is in high spirits with two days of rest in the offing – they’ll certainly need it, because the journey will only get tougher as we approach the mountains. But tonight we enjoy ourselves…I sent young Jake to purchase a jug at the general store so that we may celebrate and thank providence for taking us this far.

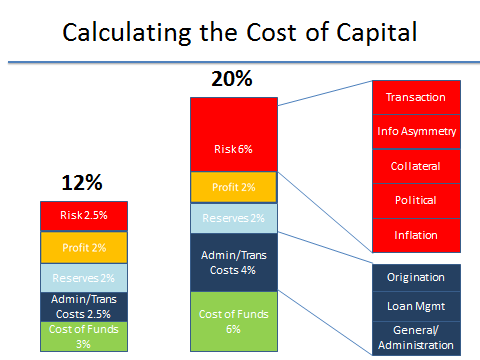

Last time we spoke about finance, the financial sector, financial intermediaries, and how they all fit together. We also uncovered what those financial intermediaries do all day (assessing risk, structuring and pricing transactions, and then placing those transactions –  either internally if a commercial bank or externally if an investment bank). Today we will dig down a bit deeper into the matter of pricing transactions, and the ways in which we in the development community may be able to bring that pricing down – allowing more transactions to take place in our target countries. Quite simply, the biggest deterrent to investment in developing countries is the high required return (for equity) and/or interest rate (for debt). How can we intervene in the short-term to push those high return and rate requirements down?

either internally if a commercial bank or externally if an investment bank). Today we will dig down a bit deeper into the matter of pricing transactions, and the ways in which we in the development community may be able to bring that pricing down – allowing more transactions to take place in our target countries. Quite simply, the biggest deterrent to investment in developing countries is the high required return (for equity) and/or interest rate (for debt). How can we intervene in the short-term to push those high return and rate requirements down?

As mentioned above, a key aspect of financial intermediation is assessing and pricing risk. Any extension of financing has a price, and that price needs to cover cost -- e.g., the cost of obtaining the funding for financing, the cost of origination and administering the financing (transaction costs), and an equitable return. That price needs to account for risk as well. This is a particular challenge in developing countries, where the risks tend to be relatively high. For instance, there are risks involved in the specific transaction (e.g. the venture may not go well, the quality of the financial information used to make the decision was faulty, etc.). There are also external risks (e.g. currency risks; risks that in the event of default the contractual arrangements may not be enforceable; political risks, etc.). Long story short – risk in in the developing world is high, and this presents a problem.

Assume an investment is projected to produce a pre-debt service income (terms in bold defined below) of 15% on revenues of $140 million ($21 million), and carries a debt load of $60 million payable in even payments over five years. If the cost of debt for that investment is 12%, then there’s not a problem (interest of $7.2 million and principal payments of $12 million equate to debt service of just over $19.3 million). But if that cost is 20% or more (as is the case in much of the developing world), debt service would rise to $24 million – above the ability of the cash flows to service (even though the venture is producing an otherwise healthy pre-debt service cash flow). So the question is: In the developing world where the cost of capital is significantly higher, how do we support otherwise viable transactions which are important to our development objectives, but can’t produce cash flows needed to service that higher cost of capital?

Buy down the risk – Through partial guarantee programs such as DCA (or other approaches, such as taking a first loss position), we can simply absorb a portion of the risk of loss to the entity providing the financing. This doesn’t affect the cash flows of the transaction, but protects the finance provider against downside risk.

Buy down the risk – Through partial guarantee programs such as DCA (or other approaches, such as taking a first loss position), we can simply absorb a portion of the risk of loss to the entity providing the financing. This doesn’t affect the cash flows of the transaction, but protects the finance provider against downside risk.

Blended capital – By mixing concessional financing with market-priced financing, we can lower the cost of funds (which lowers the overall cost of capital, although doesn’t address risk). A challenge here is that the impact on the overall transaction pricing may be minimal – a 50/50 blend of 6% (market) and 3% (concessional) funding will only bring down the cost of funds by 1.5% (150 basis points).

Partial grants – Partial grants are an effective way to encourage investments. USAID’s Global Development Alliance program (a variant of a partial grant) has produced some $20 billion US dollars (USD) in public-private investment since 2001. Partial grants work by lowering the amount of private financing needed to support the transaction, thus reducing the debt-service claims on the available cash flows.

Incentive awards – A form of a partial grant, but payable only on the outcome (in this case, evidence of disbursement on a targeted loan or investment). If offered on a competitive basis to multiple intermediaries it can drive down the payment (essentially subsidy) required to get the desired transaction done. As noted earlier, the FinGAP project in Ghana (which uses incentive awards) has generated $32 million USD in financing for (additional) agricultural value chain investments at a cost of just $1.3 million USD.

Some quick definitions for some terms used above:

- Pre-debt service income – essentially all the income from venture which is able to pay for the financing needed for that venture – which would include interest and principal for debt and any required cash-on-cash returns for investors.

- Concessional financing – funding provided on terms below what the market would ordinarily require – generally funds provided by impact investors, donors and/or international financial institutions.

- Market-priced financing – financing provided at rates offered by the market

- Debt-service claims – the required debt payments (interest and principal) which are claims on cash flows.

So now that we understand how financial instruments are priced, and some of the ways in which we can bring down the required return (or otherwise reduce the cost to make them more attractive to finance providers), we will stoke up the campfire and roll out two new vignettes.

Next up: Settle In! Two Vignettes to Simmer Over 'Round the Fire