Communications as a Change Resource

Image

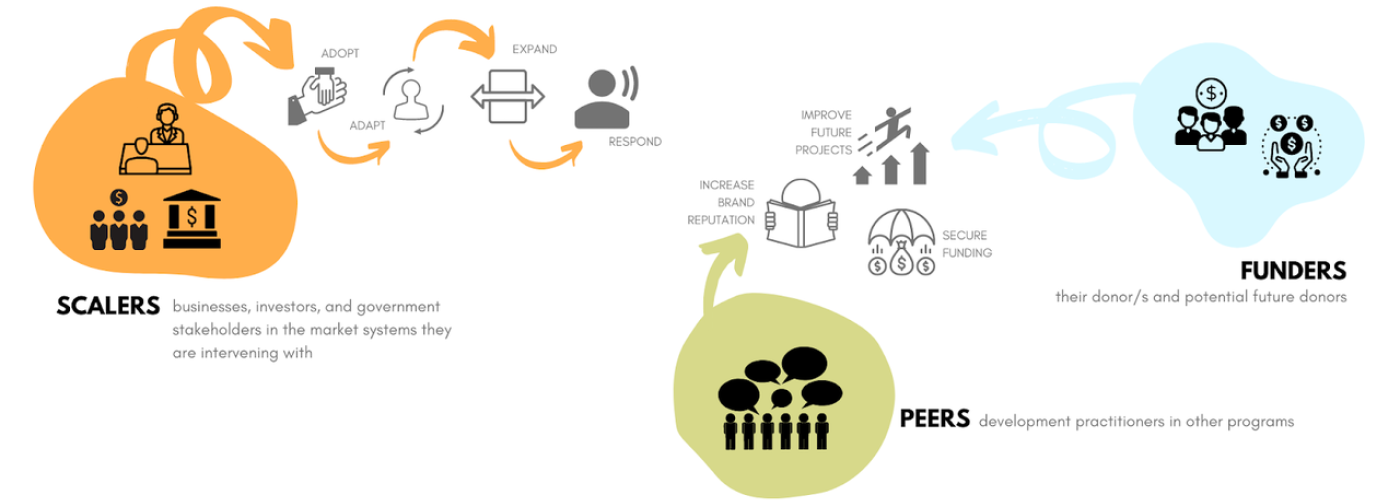

I recently had the opportunity to speak at the 2022 Market Systems Symposium on one of my favorite topics, "Communications as a Change Resouce." Given the global Market Systems Development audience, the conversations delved into how market systems or private sector development programs could better use their communications team and budget to influence change. Programmatic communications tend to think about three distinct audiences of their content - funders, peers, and scalers. While the first two are important in adaptive learning within the development space, a program can see impact tied to the results framework through the last audience. Influencing this audience means igniting "expand" and "respond" responses from additional stakeholders in the market system (investors, businesses, government, etc.).

However, what tends to stop programs from reaching the full potential of their communications efforts is that they tend to start a little too late. Understanding the audience means starting early and taking an adaptive approach. In traditional communications, we may make a big plan, design a campaign, and then spend heavily to execute it. In the markets where development often works and audience data may be lean, it is better to use an agile approach to learn about our audience. In an agile approach, we do a lot of communications tests over time, so when we do have a message to spread, we can create the right content for the right audience.

But this does not mean communications can't deliver impact throughout the program lifecycle. While we are learning about this audience, communications can pay dividends. Here are a few stories from our Amplify team at Discovered Markets, which supports communications professionals at development programs from beginning to end of the program:

- Early-on, when we are trying to find new partners to adopt a change, we don't just want to anoint a market leader; we want some self-selection. Communication on what our program's brand is and what we do, helps new players to emerge. In Commercial Agriculture for Smallholders and Agribusiness (CASA)'s case, which seeks to increase investment in agribusinesses that source from smallholder farmers, we helped spread their message to new investors and publications that investors read. This effort led to a partnership with a player they were unaware of, the Common Fund for Commodities.

- Next, when we've done some interventions, and we want it to stick with the partner, communications can help reinforce that change and help to make it part of their brand. In this phase, we are currently working with the Africa RISE program around communicating entrepreneurial events for their partner in Botswana.

- Lastly, I already mentioned the importance of expanding and respond communication efforts. For example, we worked with Elan RDC at the end of their program to ensure additional stakeholders had access to their materials after the program ended. We got 70% of these documents republished on other platforms.

It is essential to note the role of data in improving our communications and tieing it to results. The good news is there is access to automated data collection has exploded. We now know a lot more about the success of our communications efforts than just reports printed or downloaded.

The data points we incorporate into our client dashboards range from reach to engagement to consideration and action.

For reach and engagement these include:

- Outreach: Platforms contacted, Platforms responded, Platforms posted, % of content republished

- Platform Reach (including Partners): Social Reach (LinkedIn, Twitter), Web Traffic, Newsletter

- Reach: Owned Web Traffic, Organic Visits, Paid Visits, Backlinks & Referring Domains, Keyword Position

- Owned Channels: Youtube views, LinkedIn engagement, Podcast streams

Even more critical are consideration and action measures, which we can begin to tie to impact. These range from automated surveys determining audience intent and behavior, data showing new relationships and how a system has grown, or modern media monitoring tools showing how specific topics are mentioned in a digital footprint. For example, if we wanted a larger audience using the term gender lens investing, we could track targeted social handles and new reports to see if the term increased in usage over time. Specific measures include:

- Qualitative Results (based on survey and interview with sample audiences): Intended use or behavior change, Actual use or behavior change, Engagement/sharing behavior, Investment / Policy

- Network Growth: New Relationships, New Partners, Partner Satisfaction, Partner Future, Intent Engagement by other system actors

- Target Audience Communications: Natural Language Processing, Social Media Monitoring, Sentiment Analysis

Communications can be a powerful change resource alongside traditional levers like financial and technical assistance, but taking an adaptive approach early on is key to its value for the program.

So to the readers of this blog, I pose the same question I put to the audience at the Symposium last week: Think about where programmatic insights/reports had the potential to shift the behavior of a broader audience of the private or public sector actors (not necessarily active partners). What are the accelerators or barriers to communicating these insights to your target audience? What would be important metrics or KPIs to implement early to know if your communication efforts are working? How can you use communications as a change resource?

Jason is the CEO of Discovered Markets, which builds solutions for organizations to monitor, influence, and invest in systems change in emerging markets. He can be contacted at jason@discoveredmarkets.com.