Shifting Public and Private Finance Towards the Sustainable Development Goals

Image

This post was originally published by OECD Development Matters and was authored by Paul Horrocks, Priscilla Boiardi and Valentina Bellesi.

Back in 2015, the international community committed to a shared global vision towards sustainable development – the 2030 Agenda – including 17 Sustainable Development Goals (SDGs). The Goals identify the areas in which resources are most needed. But with the realization that meeting the Goals by 2030 would require filling an annual financing gap of 2.5 trillion dollars, the Addis Ababa Action Agenda (AAAA) called upon a broader mobilization of resources, including private ones.

Five years on, progress remains slow and uneven. Three critical questions emerge from this context:

- How can we drive more resources towards the Goals?

- How can we make sure they are going where they are needed most?

- And are they being used in the most effective way?

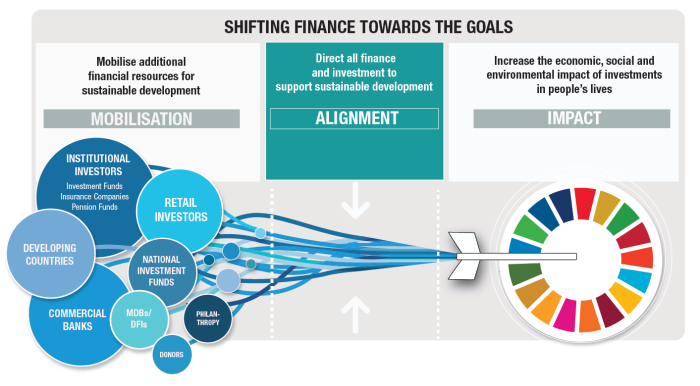

In order to guide the answers to those questions, the OECD proposes a three-step approach: Mobilisation, Alignment, and Impact.

Figure 1. A three-step approach to financing the SDGs

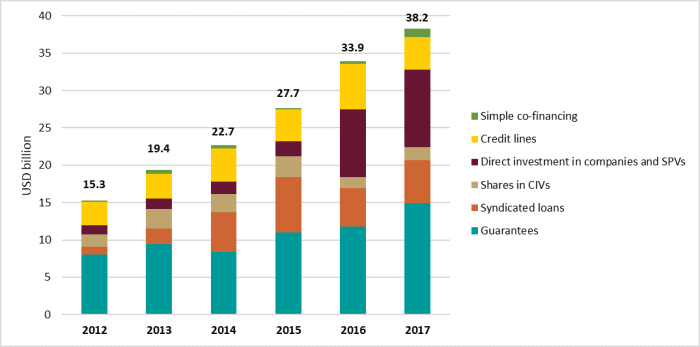

Mobilizing additional financial resources for sustainable development requires mechanisms to decrease investment risks and encourage commercial finance providers, typically through various forms of blended finance. The Blended Finance Principles provide best practices to push private capital into SDG-aligned projects, programs, and markets. Blended finance instruments, most commonly guarantees and direct investment, have proven increasingly effective, having mobilized $152bn in private capital for development from 2012 to 2017.

Figure 2. Growth in private finance mobilized for development, 2012-2017

Source: https://doi.org/10.1787/806991a2-en

Yet blended finance is not enough to bridge the SDG finance gap. To date, development finance has mobilized USD 150 billion, while the SDG gap is estimated at around USD 2.5 trillion. To fill this gap, mobilization must increase by a factor of 16 over the next decade, and governments will not be able to fund this through taxation or issuing debt alone.

The real challenge is to align the trillions invested daily in capital markets, with the SDGs. This includes resources from institutional investors, banks and retail investors, as well as remittances, foreign direct investment (FDI) and private philanthropy (Figure 1 above). However, in both the public and private sectors, a significant proportion of financial flows are not aligned, and even incompatible, with the SDGs.

In the private sector, despite claims of focusing on social and environmental impacts, few investors are transparent when it comes to monitoring and tracking their contributions. Many funds claim to be investing in the SDGs, but do not release their methodology, possibly due to commercial confidentiality. This reduces scrutiny as well as transparency, with potentially damaging effects to the sustainable development Agenda. Misalignment is not restricted to the private sector. Although Official Development Finance (ODF) is typically the first to venture into unchartered territory, there are inconsistencies in the system. For example, ODF continues to finance fossil fuel-based energy supply and generation, at an average volume of $3.9bn annually for the 2016-2017 period (OECD, 2019).

Equally challenging is measuring and managing impact. The Global Sustainable Investment Alliance reports that there are over 30.7t of assets under management (AUM) currently targeting sustainable development. If these numbers are accurate, why is the SDG gap so big? One issue is that today, we are not able to consistently track whether these financial flows are actually directed to the SDGs. Neither are we able to measure the impact of private finance on sustainable development. This is especially the case in developing countries as data collection and analysis require considerable resources. With growing risks of “SDG-washing”, public and private actors need to agree on common frameworks and standards to define sustainable investment and manage and measure its impact.

To build consensus on standards for managing and measuring positive and negative impacts, the OECD is part of the Impact Management Project (IMP) Structured Network with the U.N. Development Programme, the Sustainability Accounting Standards Board, the Global Reporting Initiative, the International Finance Corporation, the Global Impact Investing Network, and other stakeholders. The framework will help measure impact performance and integrate impact into investment decision-making by using the Financial Accounting conceptual framework (IFRS) as a basis.

Aligning finance, operations, and incentives with the SDGs

The greatest potential we have of achieving the SDGs is by aligning public and private resources with them. Focusing on scaling solutions to these challenges and looking at what aligning finance with the SDGs really means, the OECD Private Finance for Sustainable Development Conference will take place on 29 January 2020.

Watch: OECD experts shed light on what aligning finance with the SDGs really means