Out of Wind River Range and into Oregon Territory: The Four Lenses - When and When Not to Facilitate Private Capital

It is Sunday, July 25, and two days ago we passed through a wonder they call “Steamboat Spring.” It is a fearsome sight, with a mighty plume of steam boiling out of a hole in the rock and a stench of sulfur in the air. One of the party (an educated man who claimed to have attended Harvard College in Boston) said it smelled just like the "devil’s boudoir." Although no one pressed him at the time, some of the fellows pondered later as to how he had become acquainted with Beelzebub’s bedroom in the first place! Hah!

It is Sunday, July 25, and two days ago we passed through a wonder they call “Steamboat Spring.” It is a fearsome sight, with a mighty plume of steam boiling out of a hole in the rock and a stench of sulfur in the air. One of the party (an educated man who claimed to have attended Harvard College in Boston) said it smelled just like the "devil’s boudoir." Although no one pressed him at the time, some of the fellows pondered later as to how he had become acquainted with Beelzebub’s bedroom in the first place! Hah!

Although we are now more than two-thirds of the way through our journey, the party is weary and spirits are flagging. We had to say farewell to a number of families when they turned off to take the California Trail. They were with the wagon train most of the way and some strong attachments had formed. There were tears and promises to meet again, but I fear that is unlikely.

The stock continues to weaken (we lost one of the oxen last night) and our supplies are growing short. But all agree that this is handsome and pristine country and we are comforted that our progress is steady, though slow.

It has been some time since we last talked, and, as I recall, we were discussing why mobilizing private capital matters. And I believe the consensus was that:

- You stretch precious development dollars further.

- When you bring in private capital, the private sector which owns or manages that capital comes with it. And they will bring know-how and a demand for results.

- This is the era of "private capital mobilization." It is going to be an expected element within your scopes of work or proposals.

As we start on the final leg of our journey, there are only a few more topics we need to cover…but one of the most important is when to use your power to summon up private capital!

John Dalberg-Acton and J. R. R. Tolkien have both taught us that power can corrupt. We are all aware of the wizard Sauron’s fall, and how his mighty powers corrupted him. Well, don’t let that happen to you! Knowing when and when not to use your resources to mobilize private capital is important and could save you a feature article in the Washington Post (the bad kind, where you have the raincoat over your head in the picture).

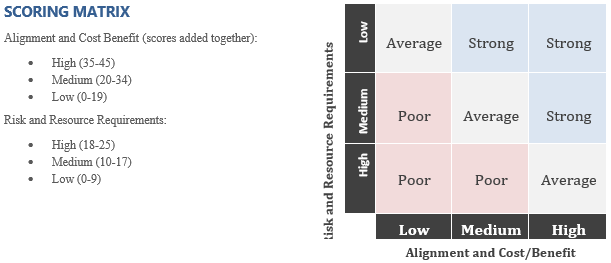

At USAID, we have developed a scoring matrix which may to useful to other development partners, NGOs and others when determining when and when not to use development dollars to attract private dollars. Essentially it looks at the opportunity through four lenses:

For each of the following bullets, rank with scores of 1 through 5 (where 1= low or weak, and 5 = high or strong), and then compare with the Scoring Matrix. The Matrix is USAID-specific, but could be adapted to other organizations' needs.

Alignment – How does the proposed engagement align with USAID’s objectives?

- Development Priority – How do expected outcomes from the targeted investment coincide with Country Development Cooperation Strategy objectives and/or broader USAID and Mission priorities?

- Evidence-Based Likelihood of Success – How strong is the evidence to support the likelihood that the targeted investment will achieve the expected outcome?

- Additionality – How likely is it that without support, the transaction would otherwise not occur?

- Spillover Benefits – How extensive are the broader benefits which might result from the investment (i.e., does this create a demonstration effect which could be replicated and scaled up)?

- Results Measurement – How clearly can the beneficiaries of this investment be identified and the expected economic benefit from the investment measured?

Cost/Benefit – How attractive is the specific transaction?

- Cost/Benefit – How strong is the leverage (expected economic benefit in relation to the resources which USAID is contributing)?

- Competition – If other entities are capable of making the same investment, how compelling is the rationale for working with this specific partner?

- Subsidy Minimization – What is the confidence level that the proposed USAID contribution is the least possible subsidy required for the investment to occur?

- Sustainability – How feasible is it that the enterprise launched with the investment will be sustained, therefore requiring little or no additional investment or involvement by USAID?

Risk – How significant are the risks?

- Reputational Risk – How likely is it that USAID support will result in reputational harm for the Agency?

- Market Distortion Risk – How likely is it that that USAID engagement will result in negative market distortions?

- Environmental and Social Risk – How feasible is it that the intervention could result in negative environmental or social impact?

Resource Requirements – How does the opportunity measure up in terms of cost/benefit?

- Level of Effort – In relation to other commercial engagement opportunities, how extensive is the time commitment from USAID vis-à-vis the expected benefits?

- Financial Resources – In relation to other commercial engagement opportunities, how extensive is the financial commitment from USAID vis-à-vis the expected benefits?

Although our journey is slow and we still have at least a month and a half to go, we have called a brief halt to give thanks for this wondrous and bountiful paradise. And when we resume refreshed, let us ponder two more vignettes.

Although our journey is slow and we still have at least a month and a half to go, we have called a brief halt to give thanks for this wondrous and bountiful paradise. And when we resume refreshed, let us ponder two more vignettes.